Malawi Teeters on Brink of Fiscal Crisis ~ World Bank

Malawi’s fiscal discipline has reached a critical point, with the World Bank sounding the alarm on the country’s alarming reliance on domestic borrowing to finance its budget deficit.

A staggering 90% of the country’s budget deficit is being financed through domestic borrowing, the highest rate among all African countries.

This short-term financing strategy, known as “Katapira,” demands immediate repayment, leaving Malawi with a crippling debt burden having food inflation hovering at 40% and average inflation at 34% indicate Malawi’s economy being on the verge of collapse

“Over 42% of the country’s total revenue is being diverted to refinance loans, exacerbating the problem. Excessive government spending, a bloated wage bill, and lack of fiscal discipline have pushed Malawi to the edge,” reads the recent World Bank’s report.

The consequences are dire: fuel shortages due to a lack of foreign exchange, hospitals without medicine, schools without learning materials, and farmers without fertilizer.

The citizenry is being denied their constitutional right to development as the situation is so bleak that the World Bank describes the citizens as the “sad people,” plagued by depression, stress, and emotional trauma.

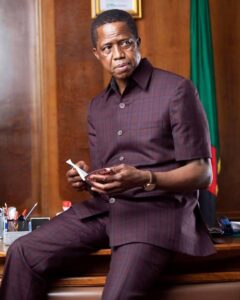

Economist and former Reserve Bank Governor Dr. Dalitso Kabambe urges President Lazarus Chakwera to take drastic measures, saying, “Stop spending what you don’t have. Spend only what you are able to generate as a country.”

Meanwhile, the World Bank recommends the adoption of a more sustainable fiscal policy, prioritizing expenditure control and revenue mobilization.

The World Bank also emphasizes the need for Malawi to diversify its economy, promote export competitiveness, and strengthen its resilience to external shocks.

Glasgow based Malawian economist Velli Nyirongo was recently quoted stating that currently Malawi’s socio-economic context presents a delicate balancing act, commended Chakwera’s directive for new austerity measures in the mid-tear budget review to align with the International Monetary Fund’ Extended Credit Facility (ECF) programme.

“Malawians are grappling with significant financial instability resulting in rising consumer prices, pervasive unemployment and an overburdened tax regime. There’s need for rationalisation of administrative expenditure, government could streamline non-essential travel, workshops and allowances which have historically constituted a substantial portion of recurrent expenditure,” cautions Nyirongo.

In his recent address to the nation, president Lazarus Chakwera told the nation that he has instructed the finance minister, Simplex Chithyola Banda to bring in additional austerity measures in the mid-year budget review to cut expenditure in line with the ECF set by the International Monetary Fund.

However, President Lazarus Chakwera’s new austerity measures are not explicitly noted, has been quite busy with international engagements having recently visited the Democratic Republic of Congo (DRC) to hold bilateral talks with President-elect Felix Tshisekedi Tshilombo.