RBM Touts Credit Reporting and Asset-Based Lending as Solution to Production Challenges

The Reserve Bank of Malawi (RBM) is promoting Credit Reporting and Asset-Based Lending as a key strategy to overcome the country’s production challenges.

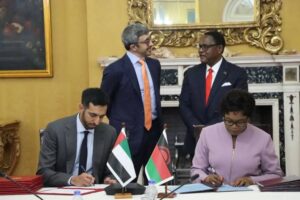

According to the new RBM Governor McDonald Mafuta Mwale, this approach will enable the private sector to access capital using movable assets, such as livestock and vehicles, as security .

The Governor emphasized the importance of this initiative during the launch of a one-year financial literacy campaign, which aims to address the country’s fundamental production challenges.

“This initiative is expected to have a positive impact on the country’s economy, driving growth and development,” said Mwale adding that “By leveraging movable assets, individuals and businesses can boost production initiatives and stimulate economic growth.”

The office of the registrar general is also encouraging people to register their movable assets with its collateral registry department aimed at providing proof of ownership and enables individuals to benefit from asset-based lending initiatives.

By promoting Credit Reporting and Asset-Based Lending, the RBM aims to increase access to capital for the private sector, particularly small and medium-sized enterprises (SMEs).